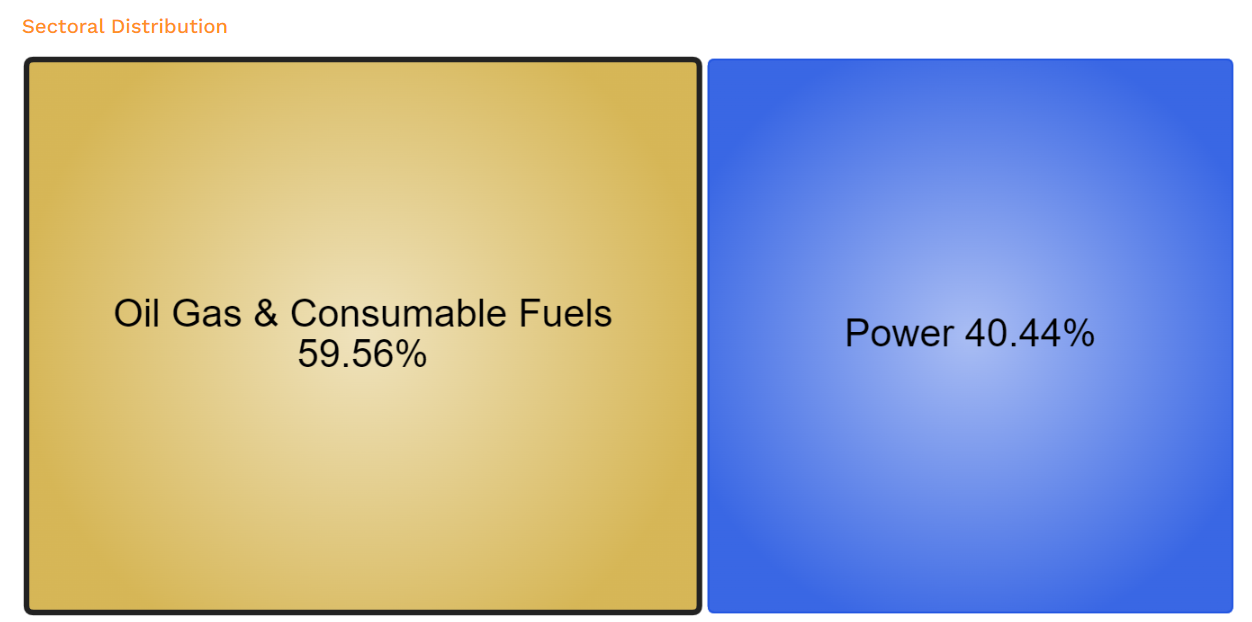

The Nifty Energy Index provides a comprehensive measure of the performance of major companies within India’s energy sector, encompassing sub-sectors such as Petroleum, Gas, and Power. This index is part of the National Stock Exchange of India (NSE) and is crucial for investors interested in the energy market dynamics. It includes key players like Reliance Industries and ONGC, reflecting their performance and the overall health of the energy sector. The index’s movements offer insights into sector trends and are essential for making informed investment decisions. For ongoing updates and more detailed analysis, you can visit Nifty’s official site or financial platforms like Investing.com (Nifty Indices).

Overview of Nifty Energy Index

The Nifty Energy Index is strategically important for investors interested in the energy sector, offering a benchmark to assess the performance of leading energy companies in India. This includes companies like Reliance Industries, NTPC, ONGC, and Tata Power among others. The index provides a snapshot of how well these companies are performing and, by extension, gives insights into the health of the energy sector in the broader economy.

Recent Performance

As of the latest updates, the Nifty Energy Index has shown positive movement, reflecting growth in the sector. Specific performances of companies such as NTPC, Coal India, BPCL, and Power Grid Corp are often highlighted, with shifts in their stock prices indicating broader sector trends. The index’s performance is closely watched by investors for signs of economic shifts, policy impact, and corporate earnings growth within the energy domain.

Importance for Investors

For investors, the Nifty Energy Index serves multiple purposes. It allows them to gauge the sector’s performance, compare it against other sectors, and make informed decisions about where to allocate their resources. Furthermore, the index’s movements can influence investment strategies, especially for portfolios concentrated in energy stocks or related mutual funds.

The index is also a tool for investors looking to diversify their holdings in energy-related stocks, providing a way to leverage sector growth through a single investment vehicle, like index funds or exchange-traded funds (ETFs) that track the Nifty Energy Index.

The Nifty Energy Index is not just a measure of stock performance but a reflection of the energy sector’s health and its future trajectory. Monitoring this index helps investors stay informed about the market dynamics and potential investment opportunities in the Indian energy sector.

For continuous updates and detailed analysis, you can track the Nifty Energy Index through financial platforms like the National Stock Exchange’s official website or other financial news and market analysis websites (Nifty Indices) (https://ticker.finology.in/).